One metric for understanding the effect that a fall in oil demand has on the price of oil is a factor called “Demand Price Elasticity.”

In economics, elasticity refers to how sensitive one factor in an equation is to another factor. In this case, the demand for oil does not respond much to an increase in the price of oil. Many people still must commute to and from or drive for work even if the price of gasoline doubles. On the other hand, recent history indicates that a relatively small, short-term drop in oil demand leads to an exponential drop in oil prices.

Academic research shows clearly that most major fluctuations in the price of oil dating back to 1973 can be largely explained by changes in the demand for crude oil.

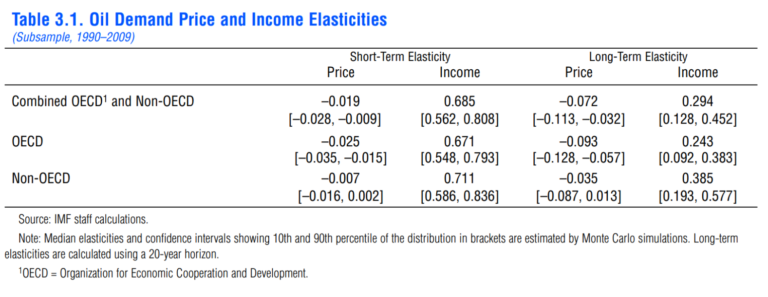

A study by the International Monetary Fund (IMF) suggests that a one percent (1%) drop in long-term demand would result in a fourteen percent (14%) drop in the long-term price of oil.

Rapid Substitution researchers estimate that a five-percent (5%) drop in demand for oil over the course of several years will result in a roughly fifty-percent (50%) drop in the price of oil.

How to Accelerate the Energy Transition